Choosing the Right Payment Processor for Your Business

As a business owner, choosing the right payment solution can make or break your ability to serve customers efficiently, reduce transaction costs, and increase profitability. Whether you’re running a brick-and-mortar store, an online shop, or a mobile service, selecting the right payment processor ensures smooth transactions and satisfied customers.

With so many options available, from traditional merchant accounts to modern payment gateways, how do you know which one is best for you? In this guide, I’ll walk you through the essential factors to consider when choosing a payment solution and how to optimize your choice for cost savings, convenience, and security.

Understanding Different Payment Solutions

Before diving into specifics, let’s break down the common payment processing options available to businesses today:

1.Traditional Merchant Accounts

A merchant account is a business bank account that allows you to accept credit and debit card payments. It connects with a payment processor that authorizes transactions and deposits funds into your account.

✅ Best For: Established businesses with high transaction volumes.

✅ Pros: Lower per-transaction fees, more customization options.

❌ Cons: Requires approval, may involve long-term contracts and monthly fees.

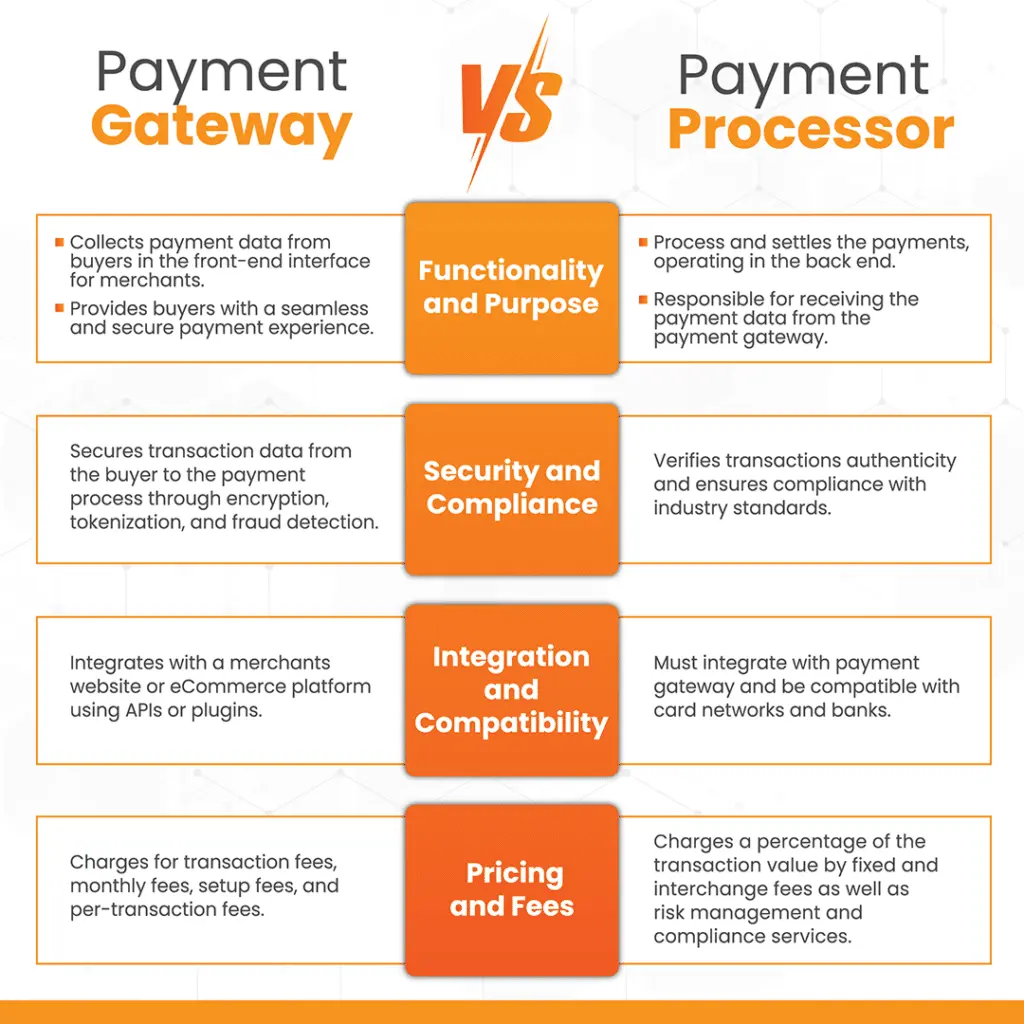

2. Payment Gateways (for Online Businesses)

A payment gateway is a service that processes online transactions for e-commerce businesses. Examples include Stripe, PayPal, and Square.

✅ Best For: Online stores, subscription services, and digital businesses.

✅ Pros: Easy setup, seamless online integration, fraud protection features.

❌ Cons: Higher transaction fees, possible account holds for suspicious activity.

3. Point-of-Sale (POS) Systems

POS systems combine hardware and software to process in-person payments. They often include cash registers, card readers, and inventory management features.

✅ Best For: Retail stores, restaurants, and service-based businesses.

✅ Pros: User-friendly, all-in-one solution, inventory tracking.

❌ Cons: Initial setup costs, ongoing software fees.

4. Mobile Payment Solutions

Mobile payment solutions like Square, Zelle, and Venmo Business allow businesses to accept payments via smartphones or tablets.

✅ Best For: Small businesses, freelancers, food trucks, and mobile services.

✅ Pros: Low startup costs, easy-to-use interfaces.

❌ Cons: Higher transaction fees, limited features.

5. ACH and E-Check Payments

Automated Clearing House (ACH) payments allow businesses to accept bank-to-bank transfers for recurring billing and high-ticket transactions.

✅ Best For: B2B businesses, service providers, and companies with high transaction amounts.

✅ Pros: Lower fees than credit card processing, good for large transactions.

❌ Cons: Slower processing times, requires customer authorization.

How to Choose the Right Payment Solution for Your Business

Consider Your Business Type & Sales Model

- Retail Stores & Restaurants: A robust POS system with inventory tracking is ideal.

- E-Commerce Businesses: A reliable payment gateway ensures smooth online transactions.

- Service-Based Businesses: Mobile payment solutions or ACH payments reduce friction.

Evaluate Transaction Fees & Costs

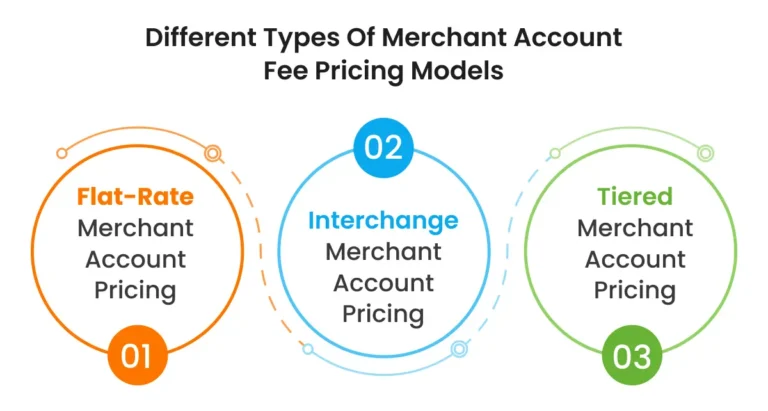

Payment processing fees vary based on:

- Flat-rate pricing (e.g., Square charges 2.6% + 10¢ per swipe)

- Interchange Plus pricing (often more cost-effective for high-volume businesses)

- Subscription-based models (fixed monthly fee instead of per-transaction fees)

💡 Pro Tip: Always compare effective rate calculations to determine the real cost of processing.

Prioritize Security & Compliance

Your payment solution must be PCI DSS compliant to protect customer data. Features to look for include:

- End-to-end encryption

- Tokenization to replace card details with unique codes

- Fraud detection tools

✅ Pro Tip: If you store customer payment details for subscriptions, ensure your provider offers secure vault storage.

Look for Flexibility & Scalability

As your business grows, your payment solution should scale with you. Consider:

- Multi-currency support for global sales

- Omnichannel payment options (online, in-store, mobile)

- Integration with your accounting, CRM, and e-commerce platforms

Assess Customer Experience & Support

A smooth checkout process reduces cart abandonment and increases customer satisfaction.

- Speed & ease of use – Does the checkout process take too long?

- Payment options – Can customers use credit/debit, digital wallets, or BNPL (Buy Now, Pay Later)?

- 24/7 support availability – Reliable support prevents downtime issues.

Top Payment Processors to Consider in 2024

Square – Best for small businesses & mobile payments.

Stripe – Best for e-commerce & subscription businesses.

PayPal – Best for online payments & brand recognition.

Clover – Best for restaurants and retail stores needing an all-in-one POS system.

✅ Recommendation: Compare providers based on your industry, transaction volume, and business goals.

Final Thoughts: Take Action Now

Choosing the right payment solution for your business is essential for maximizing profits, improving customer experience, and ensuring secure transactions. By considering your sales model, evaluating costs, prioritizing security, and exploring cost-saving options like a Cash Discount Program, you can make an informed decision.