Merchant Processing 101 – What Every Business Owner Needs to Know

If you’re a business owner, you already know how important it is to accept credit and debit card payments. But do you really understand how merchant processing works?

Many business owners unknowingly overpay due to hidden fees, bad contracts, and confusing statements. The good news? Once you learn the basics, you’ll have the power to make better financial decisions and keep more of your hard-earned money.

In this guide, we’ll break down everything you need to know about merchant processing in simple, clear terms.

What is Merchant Processing?

Merchant processing, also known as credit card payment processing, is the system that allows businesses to accept electronic payments from customers. This includes credit cards, debit cards, and even mobile payments like Apple Pay and Google Pay.

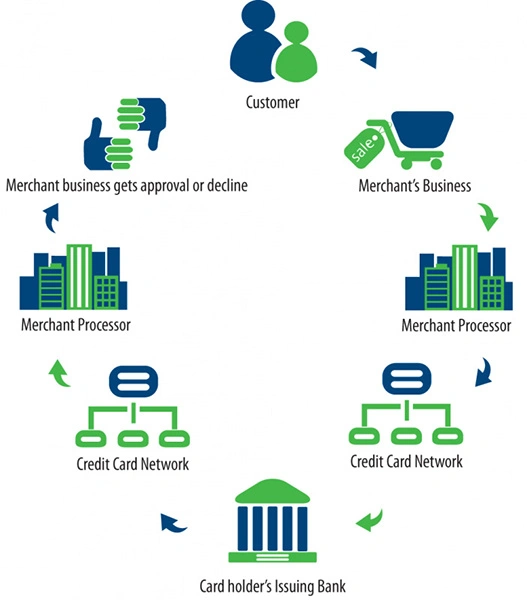

When a customer swipes, taps, or inserts their card, a series of transactions take place behind the scenes. These transactions involve multiple players, each taking a small cut of the payment. Understanding these players will help you navigate the industry and avoid unnecessary fees.

The 4 Key Players in Merchant Processing

Every transaction involves multiple parties working together to process the payment. Here’s a breakdown:

Merchant (You, the Business Owner) – The one accepting the payment.

Customer (Cardholder) – The person making the purchase.

Payment Processor – The company that facilitates the transaction between the merchant and the banks.

Issuing Bank & Card Networks – The bank that issued the customer’s credit card (Chase, Wells Fargo, etc.) and the card network (Visa, Mastercard, etc.).

Each of these players takes a small percentage of every sale, which is why it’s so important to understand fees and how to minimize them.

How a Credit Card Transaction Works (Step by Step)

Here’s a simple breakdown of what happens when a customer pays with a credit card:

Authorization – The customer inserts/swipes/taps their card at the terminal.

Verification – The payment processor sends the request to the customer’s bank to ensure they have enough funds.

Approval – The issuing bank approves or declines the transaction.

Settlement – If approved, the money is sent to your merchant account, minus processing fees.

Deposit – Funds are transferred to your business bank account within 1-2 business days.

These steps happen within seconds, but each stage comes with fees that can eat into your profits if you’re not careful.

Types of Merchant Processing Fees (And How to Avoid Overpaying)

Merchant fees are an unavoidable part of accepting credit card payments, but many business owners pay way more than they should. Here’s a look at the different types of fees:

1. Interchange Fees (Non-Negotiable)

- Charged by Visa, Mastercard, Amex, and Discover.

- Typically 1.5% – 3% per transaction.

- Varies by card type (business, rewards, debit, etc.).

2. Payment Processor Fees (Negotiable!)

- Charged by your merchant services provider.

- Varies based on your contract.

3. Monthly & Miscellaneous Fees

- Statement fees, PCI compliance fees, batch fees, and more.

- Some processors sneak in junk fees that you shouldn’t be paying!

Different Pricing Models – Which One is Right for You?

Not all merchant accounts charge fees the same way. Here are the most common pricing structures:

1. Flat-Rate Pricing

- Example: Square or PayPal

- Charges a fixed percentage per transaction (e.g., 2.6% + 10¢ per sale).

- Easy to understand, but expensive for high-volume businesses.

2. Interchange Plus Pricing (Most Transparent & Cost-Effective)

- You pay the actual interchange fee + a small markup.

- Lower costs than flat-rate models.

3. Tiered Pricing (Avoid This!)

- Processors group transactions into qualified, mid-qualified, and non-qualified tiers.

- Most expensive and least transparent pricing model.

Common Merchant Processing Mistakes (And How to Avoid Them!)

1. Signing a Long-Term Contract Without Reading the Fine Print

Some processors lock you into 3-5 year contracts with expensive cancellation fees.

2. Ignoring PCI Compliance Requirements

Non-compliance fees can cost $20-$50 per month.

3. Overpaying for Equipment

Some providers lease terminals for $50+/month when they cost $300 outright.

Final Thoughts: How to Make Merchant Processing Work for You

Merchant processing doesn’t have to be confusing or expensive. By understanding the basics, choosing the right provider, and avoiding hidden fees, you can save thousands of dollars each year.

Take Action Now:

👉 Get Your Free Statement Analysis Today!