Understanding Merchant Fees & Hidden Costs – What Every Business Owner Should Know

If you accept credit card payments, you already know that merchant fees can eat into your profits. But did you know that many businesses are overpaying without realizing it? Hidden fees, junk charges, and misleading pricing structures can add hundreds or even thousands of dollars in unnecessary costs every year.

The key to saving money on merchant processing is understanding exactly what you’re paying for, identifying hidden charges, and negotiating better terms. This guide will break it all down so you can take control of your payment processing and keep more of your hard-earned revenue.

Types of Merchant Processing Fees

Before we dive into hidden costs, let’s cover the basic types of fees that every business owner encounters:

1.Interchange Fees (Non-Negotiable)

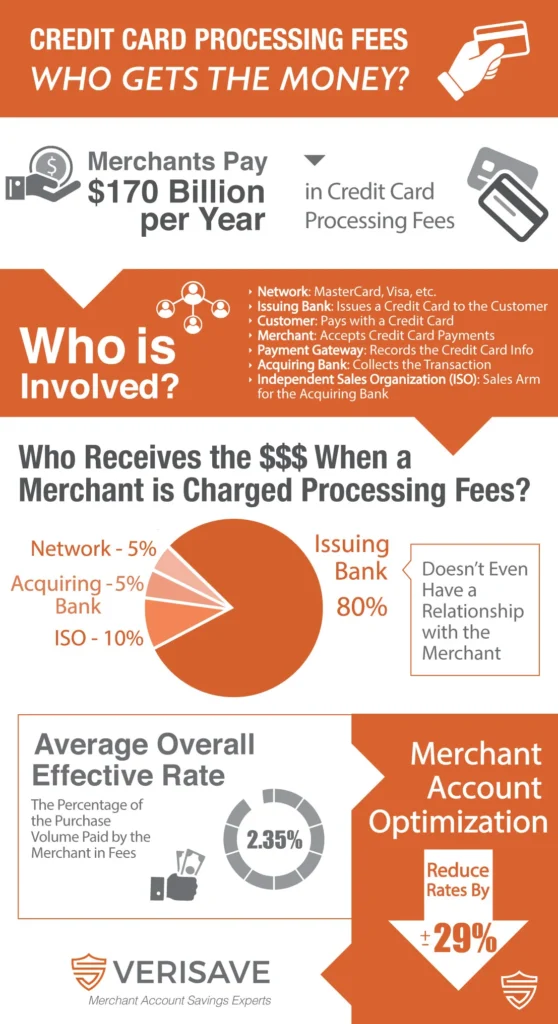

Interchange fees are set by credit card networks (Visa, Mastercard, American Express, and Discover) and paid to the bank that issued the card. These fees vary based on:

- Card type (debit, credit, rewards, corporate, etc.)

- Transaction method (swiped, keyed-in, online, etc.)

- Merchant category code (MCC) (some industries have higher rates)

📌Average Cost: 1.5% – 3% per transaction.

2. Processor Markup Fees (Negotiable!)

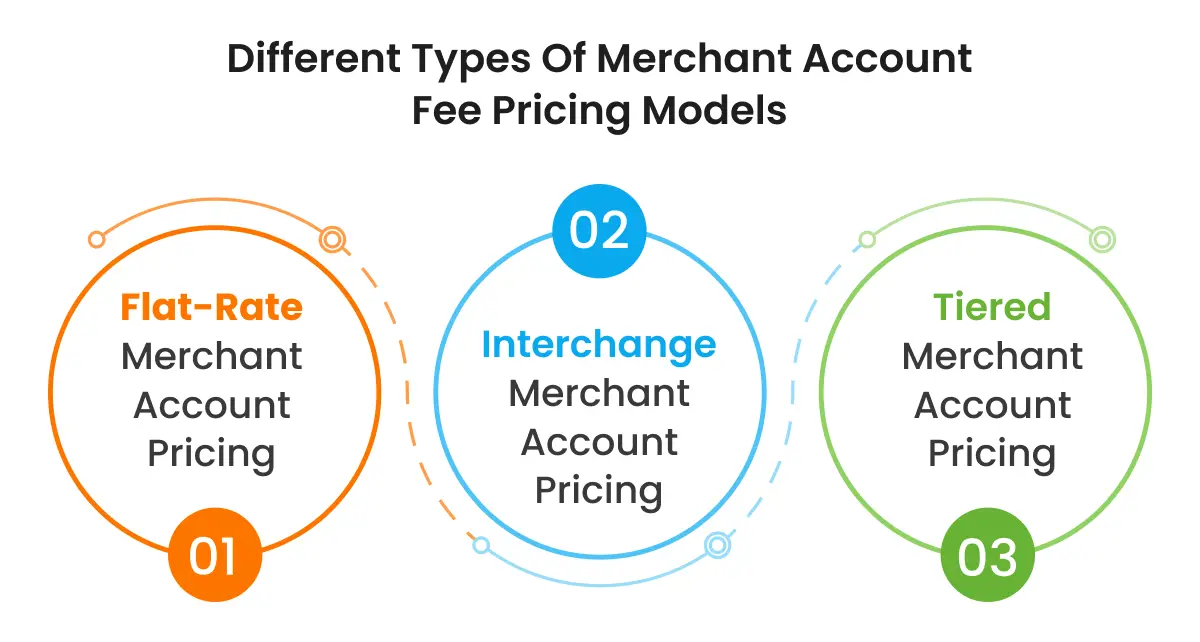

These are the fees charged by the company handling your transactions. They can be structured in different ways:

- Flat-Rate Pricing: Simple but expensive. Example: Square charges 2.6% + 10¢ per transaction.

- Interchange Plus Pricing: More transparent and cost-effective, charging the actual interchange fee plus a small markup.

- Tiered Pricing: Often misleading, bundling transactions into vague categories with hidden markups.

3. Monthly & Miscellaneous Fees

Processors often add extra charges that may not be necessary. Look out for:

- PCI Non-Compliance Fees – If you’re not PCI compliant, you could be charged $20–$50 per month.

- Batch Fees – Some processors charge a daily batch fee, usually around 10–25 cents.

- Monthly Statement Fees – Some providers charge $5–$10 just for providing a statement.

- Early Termination Fees (ETFs) – These can be $300–$500 if you try to cancel your contract early.

Hidden Fees & How to Spot Them

Now let’s talk about the sneaky charges that processors often include in their contracts. If you’re not careful, you could be paying for things you don’t need or didn’t agree to.

Many payment processors sneak in extra charges that can drain your profits. Here’s what to watch out for:

Non-Qualified Transaction Fees

This fee is common with tiered pricing models. If a transaction is considered “non-qualified” (e.g., a keyed-in transaction instead of a swiped one), you’ll be charged a higher rate.

Monthly Minimum Fees

Some processors require you to process a minimum dollar amount each month. If you don’t meet it, you’re charged a penalty.

Statement Fees

Some companies charge a fee just to send you your monthly statement, either by mail or email.

Junk Fees (AVS Fees, Security Fees, and More)

Some processors add vague charges labeled as “security fees”, “regulatory fees”, or “AVS fees” (Address Verification Service). These fees are often unnecessary and can be negotiated away.

How to Reduce Your Merchant Fees (And Keep More Profits!)

Now that you understand where fees come from, let’s talk about how to actively reduce your costs and stop overpaying.

Switch to an Interchange Plus Plan

Many processors push flat-rate or tiered pricing because they make more money off of it. Instead, ask for Interchange Plus pricing, where you pay only the real processing cost plus a small, transparent markup.

Negotiate Lower Rates

Don’t be afraid to ask for a better deal! Payment processors are competing for your business, so use that to your advantage.

📌 Tips for Negotiation:

- Get quotes from multiple providers and compare.

- Ask about waiving unnecessary fees.

- Negotiate lower per-transaction markups.

Ensure PCI Compliance

Avoid PCI non-compliance fees by making sure you follow security guidelines. Many providers offer free PCI compliance assistance—take advantage of it!

Buy (Not Lease) Your Equipment

Some processors charge $50+/month for equipment that costs only $300 to buy outright.

Monitor Your Monthly Statements

Keep an eye on your statements and look for unexpected increases in fees. If you notice new charges, contact your processor and demand an explanation.

Reduce Chargebacks

Chargebacks not only result in lost revenue but also come with hefty fees. To reduce chargebacks:

- Use clear billing descriptors so customers recognize charges.

- Implement strong refund policies to resolve disputes before they escalate.

- Utilize fraud prevention tools to minimize fraudulent transactions.

Choose the Right Payment Processor

Not all processors are created equal. Look for one with:

- Interchange Plus pricing

- Low or no monthly fees

- Free PCI compliance support

- Excellent customer service

📌 Pro Tip: Some processors offer contracts with hidden termination fees—always read the fine print before signing!

Cash Discount Program: The Ultimate Way to Reduce Fees

One of the best ways to eliminate processing fees altogether is by implementing a Cash Discount Program. Here’s how it works:

What is a Cash Discount Program?

A Cash Discount Program allows businesses to offer a discount to customers who pay with cash while passing processing fees to customers who choose to pay with a card.

How Does it Work?

The listed price of your products includes credit card processing fees.

If a customer pays with cash, they receive a discount.

If they pay with a card, they pay the full listed price.

✅ Benefit: This completely offsets your credit card processing fees, saving you hundreds or thousands per month.

📌 Important: Cash Discounting is different from a credit card surcharge, which is regulated in some states. Always ensure your program is compliant.

How to Implement a Cash Discount Program

- Choose a processor that supports Cash Discounting.

- Update signage to inform customers about the pricing structure.

- Train staff on how to explain the program to customers.

- Use compliant software to automatically adjust pricing at checkout.

💡Pro Tip: Many customers prefer cash when given an incentive—helping increase cash flow and reduce fees!

Final Thoughts: How to Stop Overpaying for Merchant Services

Merchant processing fees can drain your profits—but you don’t have to accept them as a cost of doing business. By negotiating better rates, eliminating hidden fees, and considering a Cash Discount Program, you can keep more money in your pocket.